Enhancing Scheduling Efficiency and Client Engagement with a Insurance Scheduling Software

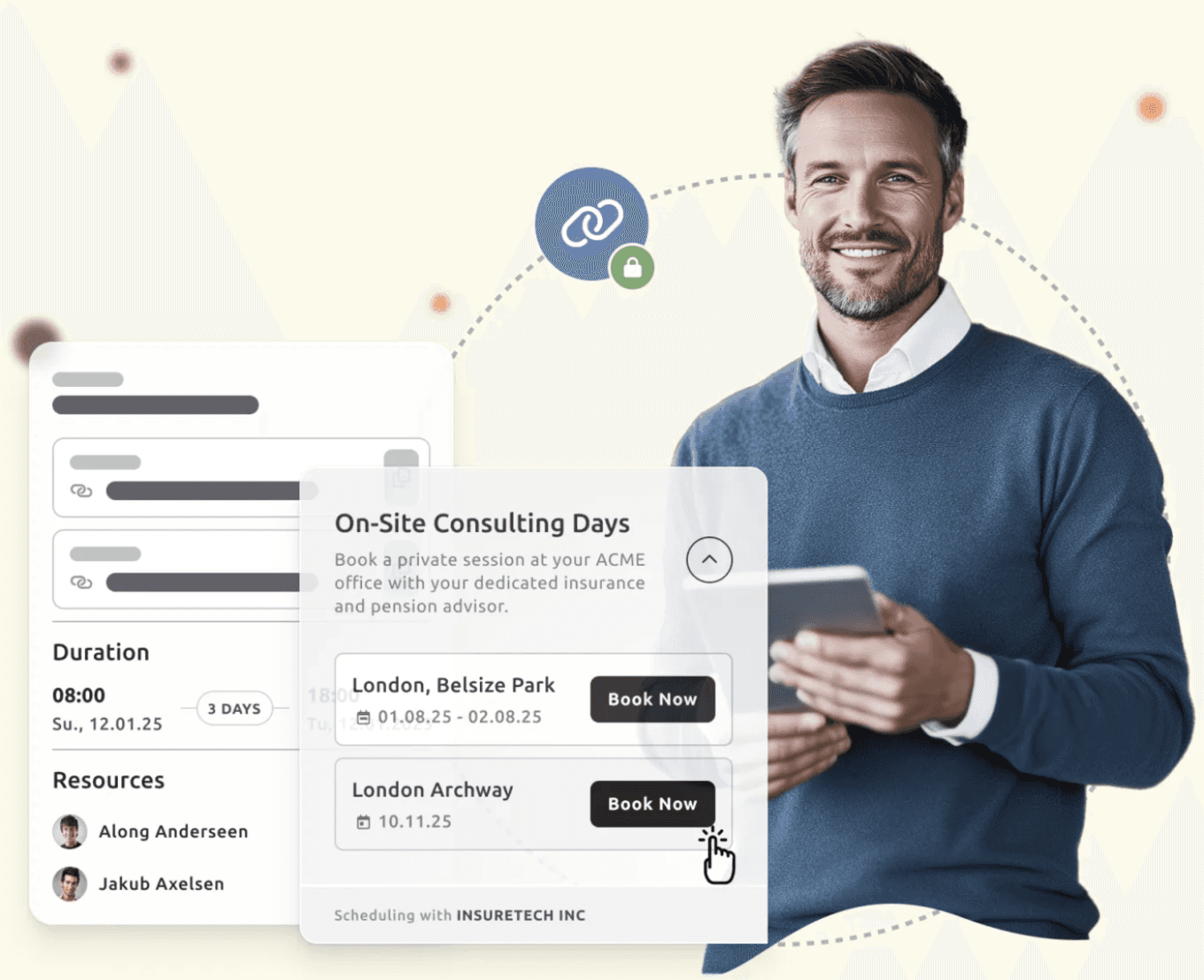

Discover how TIMIFY Smart Links transform insurance scheduling — from general consultations to corporate bAV sessions. Prevent overlaps, auto-route clients to the right advisor, and streamline appointment management in one centralised system.

Introduction

In the insurance industry, time and trust are everything. Whether it’s renewing policies, processing claims, or advising entire workforces on company pension schemes (bAV), scheduling the right insurance advisor at the right time is critical — but it’s rarely simple.

Too often, insurance agencies still rely on manual coordination or appointment scheduling software that is outdated: endless phone calls, back-and-forth emails, or outdated appointment scheduling tools that don’t reflect real-time availability. The result? Missed appointments, double bookings, frustrated clients, and advisors spending more time managing calendars than offering expert advice.

The complexity grows further when advisors specialise in different areas—whether it's automobile, life, health, or pension insurance—or when teams are required to offer services across various formats. This includes individual client consultations in B2B or B2C, VIP sessions, and exclusive corporate appointments, as well as on-site advisory services for business clients. In such scenarios, scheduling needs vary greatly: from coordinating one-on-one meetings with private customers to organising group sessions or tailored consultations at company locations. Traditional tools rarely provide the flexibility to manage this variety within a single, streamlined system.

Traditional tools simply can’t offer the flexibility to manage this variety in a single, streamlined system. They don’t support the automated booking process or provide the customizable booking pages needed to meet the diverse scheduling needs of today’s insurance professionals.

That’s where TIMIFY Smart Links come in. With smart links, insurance professionals can have full control over who can book, when, and under what conditions — while providing a personalized booking experience for clients. This means advisors are freed from the clutter of manual scheduling and can focus on what really matters: offering expert advice and building client trust.

1. Difficulty Dividing Tasks Between General and Specific Consultations

Common problem: A common challenge for insurance advisors is balancing both general consultations — like routine policy renewals or standard claims advice — and more specialized, personalized sessions for high-value clients or complex cases. Without a clear way to separate these two types of appointments, they often overlap, leaving advisors overbooked and clients waiting. The result? Inefficiency, frustration, and a poor client experience.

TIMIFY Smart Links Solution: With the right insurance appointment scheduling software that allows for easy task division, insurance professionals can reserve exclusive time slots on their online calendar specifically for personalized, face-to-face consultations. These slots can be defined in advance, set for particular days and times, and even restricted to a 3-month booking window, ensuring that more complex cases and VIP sessions are clearly separated from routine services.

This structured approach enables insurance agents to maintain smooth, daily workflows while still protecting valuable time for clients who require extra attention. By using customizable booking pages and automated booking processes, insurers can ensure that general appointments don’t crowd out more critical consultations. This results in improved time management, better client engagement, and ultimately, a higher-quality client experience.

2. Overlapping Schedules Between General and Dedicated Services

Common problem: Insurance advisors often juggle public consultation hours alongside dedicated sessions for VIP clients or corporate partners. Without a smart system in place, calendars can quickly become messy, leading to overlapping appointments, double bookings, and confusion about who is scheduled where. This not only wastes valuable time but also risks damaging client trust when advisors are forced to reschedule.

TIMIFY Smart Links Solution: By using an insurance appointment scheduling software that integrates directly with an online calendar, advisors only need to assign their own schedule once. The system automatically detects and prevents overlaps, ensuring they are never double-booked. Clients always see accurate availability, reducing confusion and improving the appointment booking experience.

With TIMIFY Smart Links, advisors can maintain a reliable, professional scheduling process without the chaos of manual coordination. The result is smoother workflows, better time management, and enhanced client satisfaction — all while keeping VIP clients and high-priority sessions properly separated from routine consultations.

3. Complicated Role Delegation Across Insurance Teams

Common problem: Insurance companies manage a wide variety of roles across their teams:

- Specialist Advisors – experts in areas like car insurance, life insurance, pension advising, or health insurance.

- Regional Teams – local branches or field agents assigned to specific areas, such as Munich or Hamburg.

- Key Account Managers – dedicated teams serving large corporate clients or VIP accounts.

As insurance companies expand their services across more locations, products, and client account structures, the process of role delegation becomes increasingly chaotic without automation.

Smart Links Solution: When creating a personalized consultation link, insurers can apply specific attributes such as product type (e.g., auto, life, health), client category (e.g., corporate, VIP, retail), or region (e.g., Munich branch). The system then automatically displays only the advisors or teams assigned to that specific role, whether it’s a specialist advisor, a local branch team, or a key account manager.

This means that clients are instantly connected with the right person, without the need for manual routing or back-and-forth coordination. It simplifies the entire process, ensuring that each client is paired with the most qualified expert — no matter how complex the structure of the insurance agency.

4. Disconnected Scheduling Tools Make Organisation Cumbersome

Common problem: In many insurance companies, scheduling is split across different tools or spreadsheets. Managers often need to check advisor calendars in one place, service availability in another, and then manually piece everything together to see if the assignments align. This siloed approach is slow, error-prone, and makes it nearly impossible to optimise resources.

The result? Insurance advisors get double-booked or scheduled for services they don’t provide, while clients face last-minute cancellations or rescheduled appointments. For businesses built on trust and long-term relationships, this disorganisation not only frustrates clients but also damages the company’s professional image.

Smart Links Solution: Rather than juggling multiple disconnected tools, insurance appointment scheduling software allows managers to seamlessly integrate all services, staff assignments, and availability in one platform.

When creating a Smart Link, managers can:

- Define available services (e.g., VIP onsite client appointments only available on Mondays).

- Assign the right advisors or teams based on expertise, location, or key account responsibility.

- Overlay this with real-time availability from advisor calendars, ensuring only feasible time slots are offered to clients.

This seamless integration means that if a service is only available on-site at a client’s headquarters, only the predefined, available slots are shown. No more confusion, no more double-bookings.

The result is a clear, centralised scheduling workflow: managers see what's possible at a glance, advisors only receive relevant bookings, and clients can book confidently without the risk of errors or rescheduling.

Is Smart Links right for you?

If you are interested in finding out what more Smart Links can do for you, we have some additional information here.

Conclusion

Efficient scheduling isn’t just an operational detail in the insurance industry — it’s the cornerstone for building trust and delivering a smooth client experience. From balancing general consultations with personalized advice, to preventing scheduling overlaps, to ensuring the right advisor is always matched with the right client, the challenges are clear.

TIMIFY Smart Links turn these challenges into opportunities. By centralising services, staff assignments, and availability in one place, insurance agents gain the structure and flexibility they need to serve clients better, reduce administrative stress, and scale their operations confidently.

Whether it’s specialist consultations, regional branch coordination, or exclusive onsite corporate sessions, Smart Links make it simple to give every client the access they need — without the chaos of manual scheduling or confusion.

Take Control of Insurance Scheduling

Start offering smarter, more structured appointments today with TIMIFY Smart Links.

Frequently Asked Questions (FAQs)

What is appointment scheduling software and how can it improve client engagement?

How can TIMIFY Smart Links help avoid scheduling overlaps in the insurance industry?

How can TIMIFY Smart Links assist with role delegation across insurance teams?

How can using Smart Links improve the overall scheduling process for insurance businesses?

What are the benefits of using Smart Links for specialist consultations in the insurance industry?

How does TIMIFY Smart Links integrate multiple scheduling tools for insurance agencies?

About the author

Lukas Alberter

Lukas embarked on his professional journey after earning a Bachelor and Master's degree in Learning Sciences and Educational Research and Management at Ludwig-Maximilians-Universität München. With hands-on experience across HR, recruitment, and educational roles—from tutoring to shaping hiring and organizational strategy at Limehome and Diakonie Rosenheim—he joined TIMIFY in a People & Culture capacity, where he now thrives as P&C Manager. Blending his academic background in learning systems with real-world HR initiatives, Lukas is dedicated to crafting an enriched workplace culture and employee experience at TIMIFY.